When we talk about the digitalization of a specific country the payment gateways being used in that country play a very significant role in the process such as in Pakistan the payment gateways play a very major role in the digitalization of Pakistan.

The line of work has goals to sell their merchandise or services through online mediums. Such companies face the challenge of finding the ultimate payment gateways in Pakistan.

Here we will have a detailed bird’s eye view of the variety of options available in the market to be a reliable payment gateway in different aspects.

Definition of Payment Gateway:

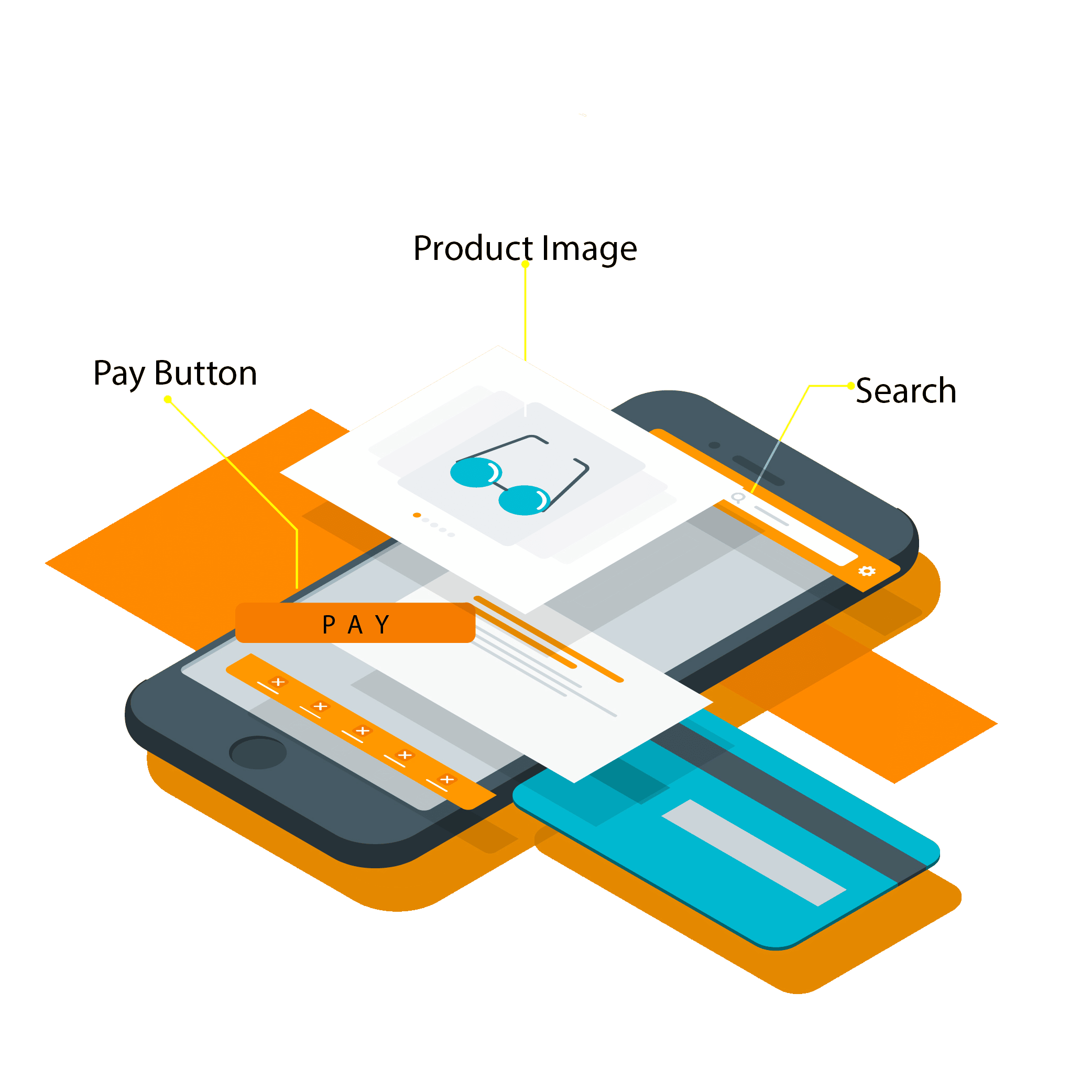

Payment gateways are high-tech mediums which provide the services of the most convenient way of making and accepting online payments to both the buyer and seller end.

The payment gateways not only include the card reading devices often used in brick & mortar stores but also consist of an online system keeping a record of the customer’s money transferred to the seller’s pocket online.

Payment Gateway

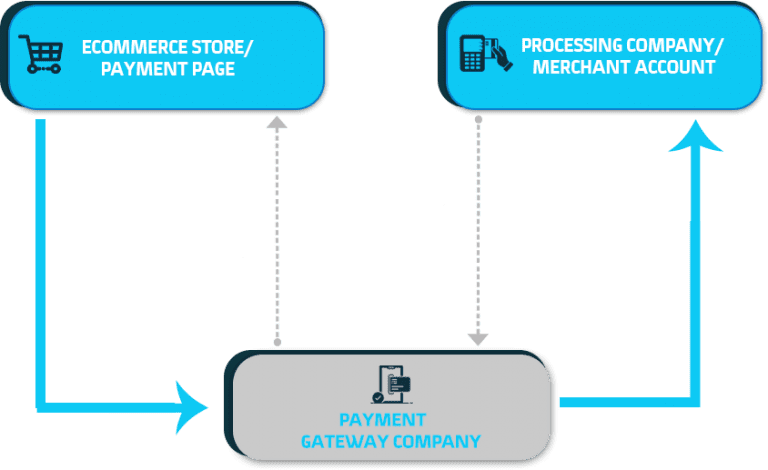

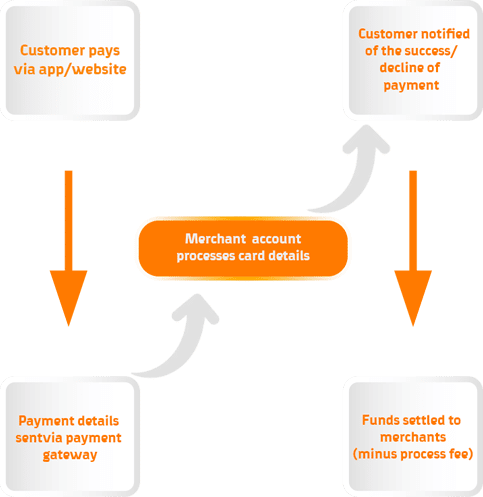

The working mechanism of Payment Gateway:

Payment gateways, especially the online mediums of payment, are the primary high-techs. The working mechanism of these high-tech payment gateways includes the following steps.

- Payment through an online application.

- Transfer of customer’s information to the seller’s bank.

- Notification sent to the customer.

- Transaction of the funds to the seller’s bank account.

Payment Gateway Work

Now we have a considerable amount of knowledge about what is a payment gateway and how its mechanism of working provides the buyer and the seller with a financial bridge between them.

Now we need to seek knowledge about some of the primary gateways being used in Pakistan right now. Let’s gather it by categorizing the gateways available in Pakistan into different categories.

Primary Payment Gateways in Pakistan – FinTech Companies

Let’s have a detailed look at the modern-day companies working as payment gateways in Pakistan and successfully providing the services of money transactions online digitally.

1. Payoneer:

Payoneer is a very well-received payment platform among Pakistani users, it was by YUVAL TAL founded in 2005 with $2 million, Payoneer is a very user-friendly platform which offers its users a convenient way of online payment digitally for different businesses, SMEs, corporates, and freelancers. it is one of the most trusted payment gateways in Pakistan.

- Its major function is providing service of online abroad payment

- They focus on providing ease and convenience while transferring money across borders

| Pros | Cons |

| Low transaction amount for a cross-border app | Higher annual fee of $29.95 |

| Cash can easily be transferred to any local bank account very easily | International transfers must be a purchasing of a service |

People working on the platforms like Fiver, Upwork and guru have been actively using Payoneer. Payoneer has also revolutionized many marketplaces like Amazon and Shopee it has a massive effect of its own in the market.

Only in Pakistan Payoneer is being used on a very large scale and is considered as one of the top payment gateways in Pakistan.

- Transfer Opportunities: Online, Telephone

- Withdrawal Alternatives: Bank

- Payment Alternatives: Bank Transfer, Credit Card, Debit Card

- Frequent Payments: No

2. JazzCash:

JazzCash is a Pakistani company providing payment services in Pakistan. It was founded in 2012 by Amir Ibrahim. It’s a digital wallet used for various types of online transactions. This app is a product of one of the leading telecommunication companies in Pakistan named Jazz.

JazzCash is basically a bank account in your mobile associated with your mobile number. But it provides portability so that we can transfer or receive money anytime anywhere.

| Pros | Cons |

| Money transfer is less time-consuming. | After installation, there is no Sign in options. |

| It's very user-friendly and has a very simple flow of cash. | Fingerprint pins sometimes create problems. |

| It can also be associated with your Payoneer account. |

JazzCash is basically a bank account in your mobile associated with your mobile number. But it provides portability so that we can transfer or receive money anytime anywhere.

Any user can make money transactions over the following data;

- CNIC

- Mobile account

- Bank account

Some other services provided by JazzCash are as follows.

- Loan repayments

- Online payments

- Insurance

- Saving plans

3. EasyPaisa:

Easypaisa was the first-ever mobile banking app introduced in Pakistan. It was founded in 2009 by Omar Moeen Malik. It was powered by a famous Pakistani telecommunication company named Telenor.

| Pros | Cons |

| The UI/UX design of the app is quite user-friendly. | Infrequent difficulties when fixing failed transactions. |

| Comparatively low transaction charges (2-3%) for the users. |

According to a survey in 2020 Easypaisa has a user family of more than 7.4 million users. The services provided by Easypaisa are as follows.

- Business and salaries payments

- Cash management

- Supply chain payments

- Online payment gateway

Easypaisa has shown a very vigorous over the past few years and have associated with the following companies and provided them with many solutions to their problems some of the companies are as follows.

- Uber

- Ruba Digital

- Seed Out

- Daraz

- Bykea

- HumMart

4. FonePay

Fonepay is also a very popular payment gateway in Pakistan. It provides very easy transaction services for various purposes.

| Pros | Cons |

| Very easy-to-use secure and very user-friendly digital services. | The mobile application has utility misconceptions. |

| Easily transact using the recipient's mobile number only. |

Primary Payment Gateways in Pakistan – Banks

When talking about any kind of transaction the first thing that comes to our mind is banks. Without banks, there is no online that can make the transaction possible. We will discuss the banks which are providing online payment gateways in Pakistan.

1. Habib Bank Limited

Habib bank limited also known as HBL is the most popular and stable banking system in Pakistan. It has a very impressive customer base with a client count of 27 million customers due to which they are in the top list of payment gateways in Pakistan.

| Setup Fee | Recurring Fee per Year | Transaction Fee | Merchant Discount Rate | Settlement Period |

| Rs. 40,000/- | Rs. 40,000/- | None | 2.5% | 14 Working Day |

While the HBL is working for achieving the goal of the unbanked population it is also striving vastly in online payment services. It provides very simple and easy ways of transactions to its customer no matter at which platform its customers require its services.

| Pros | Cons |

| Authentic payment gateway. | The long process before the online card payment forms. |

| Secure transactions platform. | High charges require for the internet. |

2. United Bank Limited:

The rival player HBL in Pakistan is united bank limited also known as UBL. It also have a very impressive customer base of 4 million customers and one of the top payment gateways in Pakistan.

UBL is one of the biggest banking networks according to a survey it has more than 44000 customer touch points and over 1400 branches nationwide.

| Pros | Cons |

| No fee is required for the transaction. | No SMS alerts via UBL Wiz card. |

Taking into account the digital payment needs of a wide array of its customers, UBL launched the UBL Go Green Internet Merchant Acquiring Service through which they achieved their goal of increasing the speed of transactions using the mighty internet.

3. Muslim Commercial Bank Limited

MCB is a very mighty name among Pakistani banks the main reason for this name is the sturdy brand image it has developed over the years.

| Pros | Cons |

| Improved security. | customer support is bad. |

MCB dominated many banks in the field of finance in Pakistan because of its huge customer base of more than 7 million customers and a very strong and stable network of 1550 branches. By launching their online banking services they provided a fair and easy chance for the merchants to increase their online sales using the system they provided.

4. Alfalh Bank Limited

In the Pakistani banking industry, Alfalh Bank Limited is another biggest payment gateway.

| Pros | Cons |

| No fee is required for the transaction. | customer support is bad. |

Bank Alfalh is a giant leader in the Pakistani banking market and is considered a reliable and well-organized payment gateway in Pakistan.

Final words for the Pakistani gateways:

It is a very challenging job of choosing among too many options for payment gateways in Pakistan. But making the ultimate right choice is very important because all the transactions related to the business are made through these payment gateways.

Many digital agencies should integrate online payment gateways to them because it is of great importance as it has been cleared by the immense growth of e-commerce in Pakistan over the past few years.

- Target location

- Target audience

- The services market needs

Some of the other factors we consider important are listed below.

- A simple fee process.

- Look at the terms and agreements

- Check transaction usefulness

- Checkout easy on all machines

- the process of integration keeps simple

Overall there is no perfect gateway but choosing the one which goes aligned with your business or line of work is a wise choice.

Top Payment Gateways of USA:

Some of the widely used payment gateways in the USA are as follows.

Stripe:

In the online payment gateway industries, Stripe is one of the major titles.

Stripe provides the customer with numerous payment methods to pay employees, set up a market, and accept payments from customers.

Subscription packages are automated through Stripe to provide the user with hustle free experience.

Stripe is a PCI Service Provider Level 1.They provide the best data maintenance and data security.

Using Stripe for your e-commerce will give your business a huge boost and optimize your work and provide user aided environment.

In their recent update, Stripe Introduced a Loan feature to provide users and to make the economy smooth.

Stripe is on its journey to introduce new features and make the platform easier to use and more reliable.

| Pros | Cons |

| Simple and crystal clear pricing. | Technical knowledge is required |

| Easy customization of payment gateway | The physically available business cannot use it. |

| Flexibility for different business types and sizes |

1. PayPal:

PayPal is providing its services around the globe.

PayPal provides a 180-day refund service to its users and is the most popular payment gateway service in the USA.

PayPal has a user-friendly interface and provides easy interaction and a Quick Sign-up option which makes it considered.

PayPal is a must for an e-commerce business

PayPal is free to use and provides a Debit and Credit Card Service for payments.

It doesn’t demand any monthly fees and security is guaranteed.

| Pros | Cons |

| You can directly pay with a PayPal account. | Customization feasibility is costly. |

| Accept global earnings | |

| Recurring billing. |

Pricing:

No fees for setup.

Inside USA per transaction 2.9%.

Outside USA per transaction 4.4%.

2. Authorize.Net:

Authorize.net is providing its services since 1966 and spearheading success.

Also, it allows you to make transactions the way you want them to happen.

They cover every feature to optimize your e-commerce business.

Authorize.net provide ideal wallets for Magento and OsCommerce-powered websites.

They charge a fee of 49$ for setup and a 29$ monthly gateway fee. But it is still a consideration for the user, especially in the USA.

They don’t compromise on data security.

| Pros | Cons |

| All main cards are acceptable | System interface is user friendly. |

| Recurring billing. | |

| Secure. |

Pricing:

- No fees for setup.

- Per Month cost is $25.

3. Amazon Pay:

Amazon a name familiar in the e-commerce sector has its leverage when it comes to gateway payment methods.

Users can use their Amazon accounts to set up their Amazon gateway payment method which allows the user to check in without leaving the shopping window.

Using Amazon as a gateway method will smoothen the transaction method leading to fewer cart abandonment cases.

As Amazon is an e-commerce platform it provides features that are easy to use and solve every problem during transactions.

Amazon Pay saves you from frauds and schemes using the Fraud Detection method. It also provides customer verification which protects accounts from unauthorized access.

| Pros | Cons |

| Regular updating. | Withdrawal takes time. |

| Secure for customers. |

Pricing:

- No fees for setup.

- Inside USA 2.9% per transaction.

- Outside USA 3.9% per transaction.

4. 2Checkout:

2Checkout is a saving platform that provides data security and doesn’t compromise on the security of User Data

2CheckOut is providing global services and maximizes revenue by providing extraordinary services and also provides all-in-one monetization.

If you face a problem don’t worry 2Checkout is there with 24×7 custom care providing specialized support.

User data is protected, and Privacy is a top priority.

2Checkout keeps up with digital world complexities and provides billing services.

| Pros | Cons |

| 200 countries payments are acceptable. | Restricts some products. |

| Secure and good management. |

Pricing:

- 2Sell plan cost 3.5% per transaction.

- 2Subscribe plan cost 4.5% per transaction.

- 2Monetize plan cost 6.0% per transaction.

Top Payment Gateways of UK:

The trend of using online payment gateways made immense growth with the extraordinary growth of the internet. In the UK this trend was set long ago than in many countries. Many local businesses in the UK are situated with the most popular payment gateways in the market of the UK. Some of the most reliable payment gateways in the market of UK are as follows.

- Worldpay

- Paypal

- Stripe

- Amazon pay

These are the major and mostly used payment gateways among many others in the market publicly in the UK. All of these gateways have their own unique features as well as they have their own pros and cons.

1. Worldpay:

Worldpay is the roaring lion in the market of the US among the many options of payment gateways. It was launched on January 16, 2018, and the present parent of this company is FIS (Fidelity National Information Services).

According to a report by Statista, a German-based company that provided the statistics for 2017 Worldpay was a leading payment gateway through which approximately 7.9 billion transactions were processed as per the respective year.

Worldpay has completed many milestones in a very short time and gained many rewards such as.

- The Worldpay from FIS received a reward for Best Performing Gateway.

- Also received awards for the authorizations.

Worldpay has many reliable features as compared to other payment gateways being used in the market.

- as fraud

- risk management

- recurring payments

- currency conversion

Worldpay which is a UK-based payment gateway enables us to use an online platform that provides us with the opportunity to receive payments from customers through phones or laptops in a very secure and reliable way.

Worldpay has many features which increase its reliability and makes it trustworthy for users.

Features:

- Secure payments

- Price plans are flexible enough

- All cards are accepted

- Real-time reporting is possible

As we know that there is nothing perfect everything has its benefits and drawbacks as well. So here are some of the advantages and disadvantages of Worldpay.

| Pros | Cons |

| Provides virtual airfield | Costly |

| Payment keys for businesses | |

| recurring payments |

2. PayPal:

PayPal is considered one of the most reliable and popular online payment gateway all over the globe. It has been working consistently since it was founded in December 1998. It is the consistency and hard work of the company that today they are working as the most familiar brand all over the globe.

PayPal is providing its services around the globe.

PayPal provides a 180-day refund service to its users and is the most popular payment gateway service in the USA.

PayPal has a user-friendly interface and provides easy interaction and a Quick Sign-up option which makes it considered.

PayPal is a must for an e-commerce business

PayPal is free to use and provides a Debit and Credit Card Service for payments.

It doesn’t demand any monthly fees and security is guaranteed.

Features:

- Easy set-up

- Provide protection from fraud.

- Offers buy now, pay later solution

| Pros | Cons |

| You can directly pay with a PayPal account. | Customization feasibility is costly. |

| Accept global earnings | |

| Recurring billing. |

3. Stripe:

Stripe was founded in 2010 and since then they have been working steadily for ultimate success and making their place in the market at the top they have done very well for the position they have achieved today.

Stripe is an Irish-American-based company which have its main two headquarters situated in Dublin and San Francisco. The process to have to achieve great popularity among the several payment gateways of the market in the UK.

Stripe is on its journey to introduce new features and make the platform easier to use and more reliable.

Features:

- It provides complaining services

- It reports to us about our sales live.

| Pros | Cons |

| Simple and crystal clear pricing. | Technical knowledge is required |

| Easy customization of payment gateway | The physically available business cannot use it. |

| Flexibility for different business types and sizes |

UK payment gateways -Banks:

1. Lloyds Banking Group:

In the UK Lloyds Banking Group is one of the largest banking organizations. Lloyds Banking Group was established in 2009, it has four deputies: Lloyds Bank, Bank of Scotland, Halifax, and HBOS. In UK and London, Lloyds Banking Group is viewed to be the second-largest bank.

| Pros | Cons |

| Self-growth is highly motivated. | According to area culture dependency. |

2. Barclays

Barclays is a multinational bank settled in London and works in 50 countries around the world. It offers different banking services like individual banking, security, corporate banking and an abundance the executives.

| Pros | Cons |

| Low costs. | Restricted to UK products. |

| Huge basic research and solid background. | Bad in Client consent. |

3. Santander UK:

Santander UK is a bank that delivers retail, commercial and worldwide corporate financial administrations. It also delivers services through different stations like the internet, ATMs, portable and phones.

Pricing:

Everyday current banking has no monthly cost while 300$ daily withdrawal restriction.

| Pros | Cons |

| In online services, navigation is easy. | In online services, live chatting is not allowed. |